11588 NE 150th Ave Road Fort McCoy, FL 32134

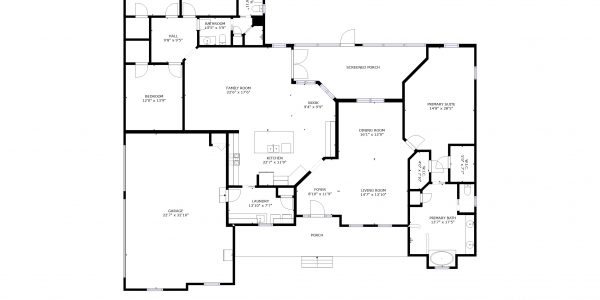

| Custom built TL Carlson home with beautiful attention to detail throughout the interior and exterior. Located on 14.31 acres on paved road this home was originally built in 2007 but shows pride in ownership and wonderfully cared for. Home includes 2,769 living square feet with 4 bedrooms, 2 bathrooms. The front covered porch invites you to relax in the rocking chairs or swing and enjoy the view of woods and beautiful sunrises. Upon entering the home you will find spacious living room and dining room combo with textured laminate flooring, crown molding, and soaring ceilings. Kitchen is custom with beautiful solid wood cabinets, granite counters, large center island w/ sink, gas stove and oven, french door fridge w/ bottom freezer and built in microwave. Family room and kitchen is open floor plan with more crown molding, high ceilings and great space for entertaining; includes breakfast nook/dining area with window views of the screened/covered back porch. Main bedroom is spacious in size with his and hers walk-in closets. Main bathroom is spacious including double sinks w/ cultured marble counter tops, privacy toilet, soaker tub, step in tiled/glass shower and tiled floors. Guest bedrooms are spacious in size with walk-in closets, comfy carpet and high ceilings. Guest bathroom includes 2 private bathrooms including 2 vanity’s w/ cultured marble sinks, and shared tiled shower/floors with glass door enclosure. Laundry room is located just off kitchen; oversized with storage closet, custom cabinetry, crown molding, wash basin and washer/dryer are included. Garage is oversized 34’x23′ with room for cars and few toys. Some custom features found throughout the home includes; recessed lighting, high ceilings and crown molding. Outside include 12’x24′ wood shed. Pressure washed and freshly painted outside. Located 10 minutes to downtown Fort McCoy with grocery store, doctor office, pharmacy, hardware, gas station, pizza and more. Short drive to Silver Springs which includes Walmart, Lowes, Bealls, Outback and many more of your favorite shopping spots and restaurants. Ocala is only another 10 minutes from Silver Springs with vibrant night life and lots of entertainment options and restaurants. Gainesville(Home of Florida Gators) is only 50 minutes to downtown. If you’re a fisherman, hunter or simply love hiking, canoeing or kayaking you are in luck! Minutes to Ocklawaha River, Ocala National Forest and many natural springs(Salt Springs, Silver Glen Springs, Juniper Springs), horseback and walking trails, and off road vehicle trails awaits your explorations. One of a kind property and location! Ready for new owners! |

- 4 Bedrooms

- 2.5 Bathrooms

- 2007 Concrete Block Home

- 2,769 Living Sq. Ft

- 14.31 Acres

Offered at $688,000