|

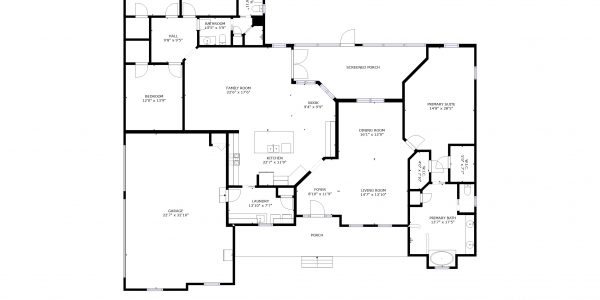

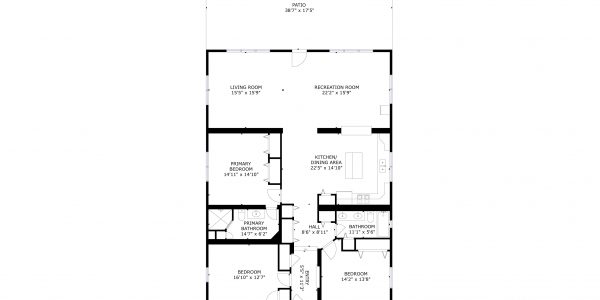

“Sunrise Special” is the perfect name for this beautiful Lake Kerr home. Wake up to stunning sunrise views from either the Living room, Kitchen, Main Bedroom and 2nd bedroom. The property is .15 acres and with 60′ of lake frontage. The home was originally built in 1992 including 3 bedrooms, 2.5 bathrooms and 2031 living square feet. As you arrive to the property you will see 2 story home with brick face and vinyl siding and 2 concrete parking areas. Entering the home is a inviting large living room to the left with brick wood burning fireplace. To the right is formal dining room with beautifully renovated new kitchen just a few steps away and 1/2 bathroom for guest. Kitchen includes all new: cabinets, granite countertops, stainless appliances(range, refrigerator, dishwasher), recessed lighting and large picture window with view of the lake. Just off kitchen is bonus room perfect for office or play room with french doors and large walk in pantry. Upstairs includes 3 bedroom, 2 bathrooms and laundry closet. The main bedroom is spacious in size, includes high ceilings with lake view and walk in closet. The main bathroom includes Jacuzzi jet tub, tiled shower enclosure w/ glass door and new updated double sink vanity with granite top. Bedroom 2 and 3 are cozy in size and located upstairs as well. There has been many updates including; new laminate flooring downstairs, carpet upstairs, interior paint, and new landscaping. The back of home is great place to take in all of the lake view with 12’x29′ screen room with vinyl windows. Lake side has metal bulkhead/seawall, 2 story viewing deck including boat house and 14’x16′ dock to soak up the sun and/or do some fishing. HVAC and shingle roof less than 5 years old. Don’t miss seeing this Lake Kerr Key “Sunrise Special” Home Lake Kerr is approx 2800 acre spring fed lake and 2nd largest lake in Marion County. Located in the Heart of the Ocala National Forests. Lake Kerr also has access to Little Lake Kerr(Lake Werner). Some of the best fishing in Central Florida with largemouth bass, bream, catfish, specks and more to challenge you daily. Unique shape of lake lends great opportunities for every kind of water sports including wakeboarding, waterskiing, canoeing, kayaking, tubing or just going for relaxing boat cruise. There is only one public boat ramp(Morehead Park) with beautiful Kaufman Island located in the middle of lake. Located in the heart of the Ocala National Forest w/ beautiful Salt Springs swim area, boat launch and short ride to Lake George and the St. Johns River. Salt Springs is also home to miles and miles of ATV/SxS, Horseback and hiking trails. Great fishing year round in the many lakes, rivers and forest ponds, and don’t forget about the excellent hunting too. Close to local shopping including grocery store, Dollar General, hardware, gas station, great restaurants, entertainment and more. Only short 30 minute drive to Ocala or Palatka for all your needs. Asking Price – $420,000

|