Happy Friday!

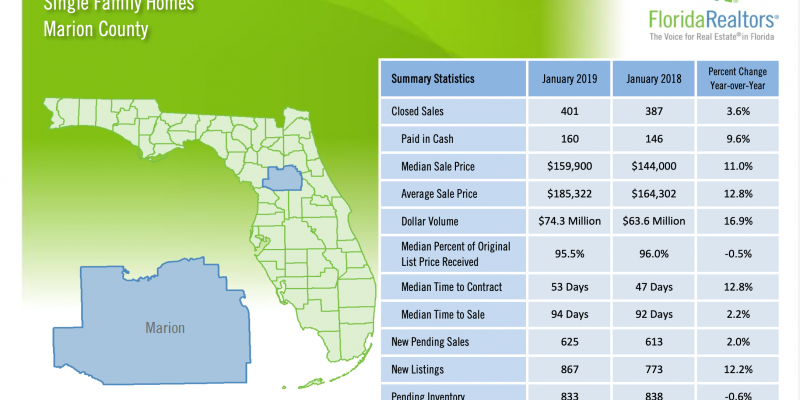

Here is January’s real estate market report for Marion County! As you can tell inventory is low, and home resales are up! Not to mention interest rates hit a 3 month low! Now is a great time to buy and sell real estate!

Please call/text me if I can help in anyway! (352) 577-9171