Did you know that the color of the year for 2020 is classic blue? Shades of blue are very trendy right now for the exterior and interior of your home. What do you think? Would you use shades of blue in your home?

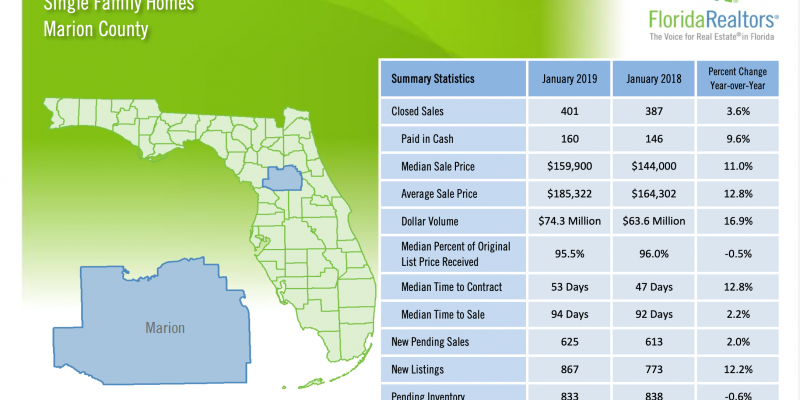

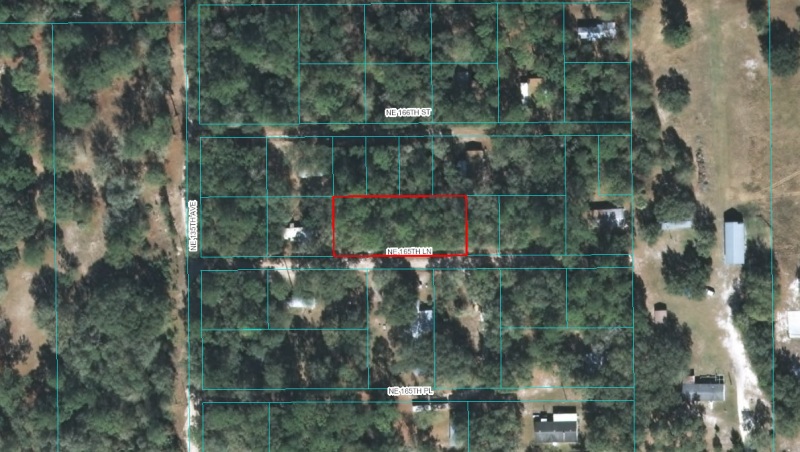

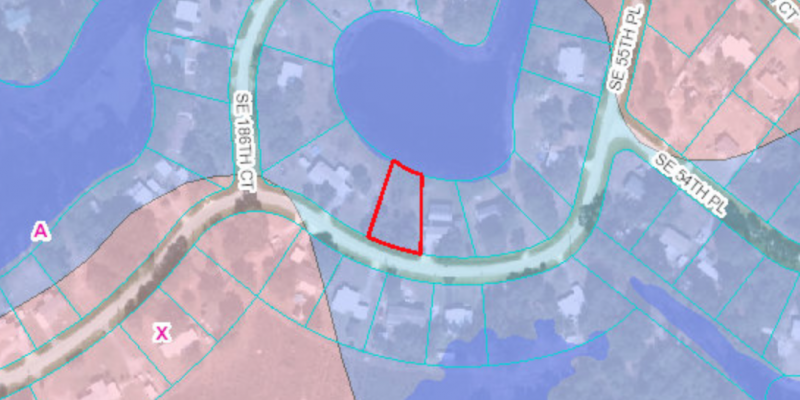

Thinking about selling or purchasing real estate? Call me! I would love to help! (352) 577-9171