Good Afternoon, Everyone!

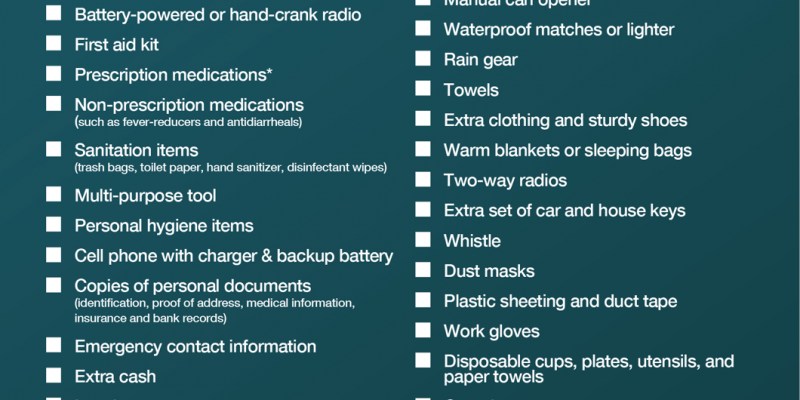

With everyone going right now during this pandemic the best thing you can do is try to be prepared! I create this checklist of items either to purchase or make sure you have available in your home. If there is anything I can do to help you during this difficult time please let me know!