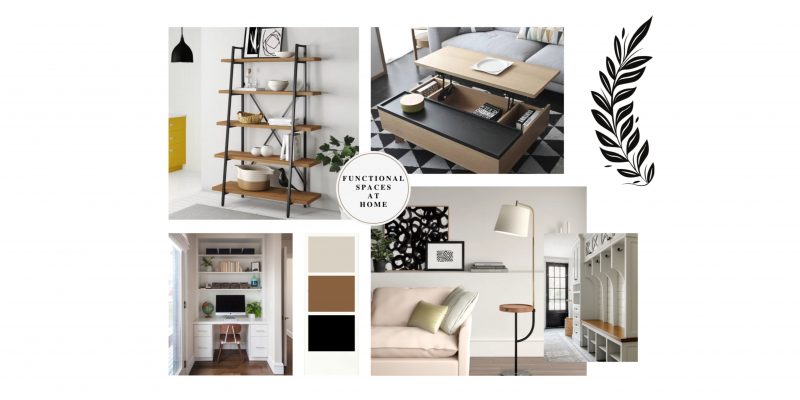

10 Ways to Make a Room More Functional

- Maximize vertical space

Take advantage of wall height by adding tall bookcases, cabinets or shelves, or by hanging hooks for jackets in the hallway, separate office or study, add a desk in a corner of a bedroom or living room, preferably under a window to take advantage of the natural light and to keep your back turned from distractions like the TV and bed. - Keep traffic paths clear

Avoid bumping into furniture by creating an efficient layout. Make direct paths to commonly used zones and leave enough space to manoeuvre around each piece of furniture. - Control clutter

Get rid of items you no longer need or use, deal with paperwork as it comes in, file important items in labelled folders or boxes, and return everything to its original place when you’re done with it. - Add storage

Store like items – such as cleaning products or bathroom supplies – in labelled boxes or plastic bins. For particularly unkempt areas, purchase storage options like an over-the-door rack to get shoes off the floor, or a closet-size second shelving unit to stash seasonal clothing. - Create a nook

If you don’t have the luxury of a separate office or study, add a desk in a corner of a bedroom or living room, preferably under a window to take advantage of the natural light and to keep your back turned from distractions like the TV and bed. - Use a room for what it’s intended

Keep the children’s toys in their bedrooms or playroom and out of the living room, do paperwork or homework in a home office or den – not the dining room – and move all of your craft or woodworking projects out of the kitchen and down into the basement or crafts room. - Store items in the rooms in which they’re used

Keep table linens in the dining room, books and magazines in the den, dish towels in the kitchen, and detergent in the laundry room. - Purchase double-duty furnishings

Select pieces that are versatile, such as a coffee table with a shelf for magazines and books, a lighting for reading, eating or writing, and for setting the mood. - Have multiple table surfaces

Rather than having to get out of your chair every time you want a sip of coffee, make sure that there are enough surfaces within arm’s reach of living room seating to hold items such as drinks, books, table lamps and reading glasses. - Purchase efficient lighting

Ensure that your space has table lamps, floor lamps and other lighting for reading, eating or writing, and for setting the mood.

Thanks for reading!