Good Day All,

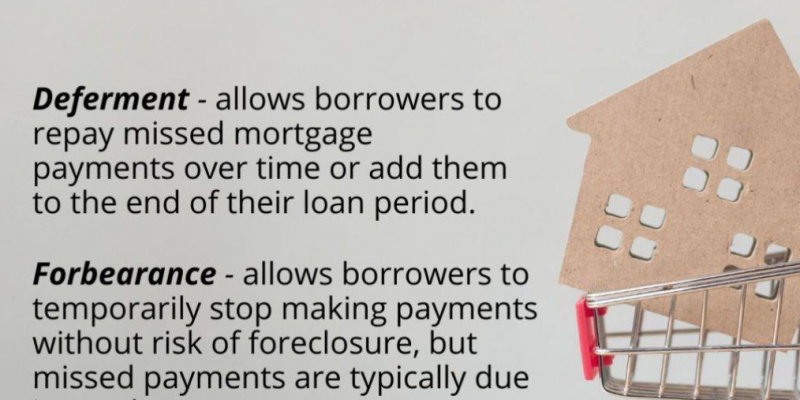

With all of the challenges that we’re facing due to the Coronavirus, I have had heard a lot of people wanting to know what their options are with their mortgage payments. We have all heard of the terms deferment and forbearance, but do you really know what they mean?

Deferment – Allows borrowers to repay missed mortgage payments over time or add them to the end of their loan period.

Forbearance – allows borrowers to temporarily stop making their mortgage payments without risk of foreclosure, but missed payments are typically due in one lump sum.

I hope this helps! Before making any decisions I would recommend talking to a loan officer or your financial advisor. For all of your real estate needs please feel free to contact me! (352) 577-9171