The housing market is as hot as it’s ever been. In some areas, homes are going under contract almost as soon as they come on the market and prices keep going up, up, up.

COVID-19 has impacted how people use their homes and where they want to live, and historically low interest rates have pushed thousands of additional buyers onto the market. Could prices keep going up? Many homeowners are wondering whether holding on to their homes until 2022 makes sense.

We’ve spoken with experienced Realtors, and one thing is clear: if you’re on the fence about selling your home, don’t be. Now is a great time to sell a house, and things can change quickly: 2022 may not be the white-hot seller’s market that 2021 has been so far. Here’s what you need to know.

Should I sell my house? Rising interest rates indicate “Yes”

One of the big reasons buyers flooded the market this year – despite the uncertainty of a pandemic – was the historically low interest rates.

Low mortgage rates meant that buyers could save thousands of dollars over the lifetime of their home loan, so many potential buyers who were waiting on the sidelines began searching for their dream home. The incredibly low rates also meant that people could upgrade from their old home into a larger one while maintaining the same monthly mortgage payments.

All pendulums eventually swing the other way, though, and Spring 2021 has seen mortgage rates begin to rise – and they likely will continue to do so, thanks to renewed economic activity.

“It’s smart to get on market while the rates are so low,” advises DC-based listing agent Angela Allison. “The rates are going to go up, they have to go up, and we’re going to start to see a turn in buyer demand. It’s so crazy how this market turns on a dime – it can shift that much, that quick. Get on now, because we really don’t know what’s going to happen in the fall.”

Allison is right: there is a clear relationship between interest rates and home buying activity. According to CNBC, when the interest rate for 30 year fixed-rate mortgages increased from 2.96% to 2.98% this February, mortgage applications fell by 5.1%.

Now imagine the drop of home loan applications the market might see if the mortgage rates rise by half a percentage point instead of .02, and you’ll begin to understand just how much of an impact the low rates have been having on the current housing market. When rates go up, buyers can’t qualify for the same amount of house as before.

“Prices are at all-time highs. Rates are rising which will lower the buyer price points, which will stall the market,” explains Tampa-based listing agent Windy Back. “If we raise rates to a point where buyers are knocked out of being able to purchase, then yes, it’s going to create an issue.”

Once mortgage rates rise significantly – and it’s not a matter of “if,” it’s a matter of “when” – thousands of home buyers are going to retreat from the market, softening some of the red-hot demand we’ve been seeing.

“We’re definitely seeing some shifts in interest rates,” notes Baltimore-based listing agent June Piper-Brandon. “It starts to come out of the buyer’s pocket and it hurts more. With lower interest rates, people could get more home for the same price. That quarter of a point can be the difference between qualifying for the home of your dreams, and not qualifying for the home of your dreams.”

Chart via YChart shows 30 year mortgage rates rising above 3% this March

Supply is lower than ever… but will that hold?

Across the U.S., there are fewer homes on the market, period – and this is helping to push prices sky high. Housing inventory declined 39.6% on a national level in 2020, according to Fool.com. Sellers have all the bargaining power when there are so few homes to choose from, and low inventory often forces buyers to bid over asking price on homes.

By selling now, you get to reap the benefits of a low inventory market. That means a better chance at getting multiple bids, cash offers, no contingency offers, and above-asking price offers. Once buyers have more options, they’ll also have greater leveraging power when it comes to the closing table – and you’ll be waiting longer for your home to sell.

Some factors that can impact 2021/2022 housing inventory:

Backlog of foreclosures

When COVID-19 hit, the U.S. government issued foreclosure moratoriums to prevent people from losing their homes. Homeowners who were having trouble paying their mortgage could request an extended forbearance that would last until the end of June 2021. For this reason, very few foreclosures have been on the market in the past year – even fewer than usual.

Eventually, though, the moratorium will end – and some people are not going to be able to hold onto their homes. “All the people that have been furloughed or laid off because of COVID – they’re going back to work but they may be making less than they were making before, or maybe they’re only back part time,” notes Piper-Brandon. And some foreclosures will happen for typical, non-COVID related reasons.

And once foreclosed homes hit the market, they tend to lower the value of nearby listing homes by way of affecting supply. Once there are more discounted homes that can be snapped up, there is decreased demand for homes listed at top dollar.

“There’s a backlog of foreclosures that have not hit the market. As soon as that shadow inventory starts hitting the market, your prices and your comps are going to start to drop,” explains Piper-Brandon. “And as a result, you’re no longer going to get the value that you would’ve gotten in the current market place.”

Home building is up

Home building in the U.S. nosedived after the 2007 market crash and has only been slowly climbing up over the past decade – in other words, not yet keeping pace with how many people want homes.

Today, though, home builders are feeling more confident in the market, and they’re starting to push out more homes than before.

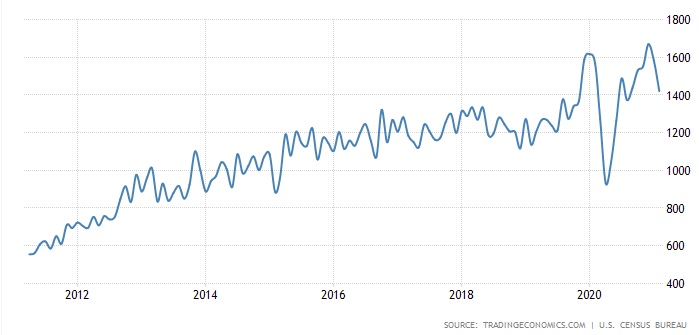

Data from the U.S. Census Bureau indicates that – with the exception of a short dip that occurred during the beginning of COVID-19 – more and more homes are being built every year to accommodate the growing population (chart: 800 = 800,000 homes).

source: tradingeconomics.com

Coronavirus Restrictions are Ending

By June, anyone in the U.S. who wants a COVID-19 vaccine should be able to access one, according to the government’s current rollout timeline.

Many homeowners were holding on to their homes due to the uncertainty of the market and their own lives – many people switched to working from home, which made commute considerations a thing of the past. And others had to deal with lost income that impacted their ability to buy a new home, and therefore move out of their old one.

As the national economy begins to approach normalcy again, though, many of the temporary reasons people were holding on to their homes will fade away.

“Buyers are exhausted right now; it’s been such a bidding war. I highly recommend getting on market now, before the dog days of summer. With the vaccine, everything’s opening back up; it’s going to be a more normal market this year and July and August are going to be really slow,” advises Allison.

Baby boomers will be aging out of their homes

Did you know that baby boomers (ages 57-75 approx.) currently hold about a third of the U.S. housing stock – or about 21 million homes? Over the next decade, millions of baby boomers will be entering retirement homes, dying, moving in with relatives, or downsizing, and the result will be thousands of additional homes entering the market each year.

Your goal as a home seller should be to get in front of all these homes entering the market, rather than coming in at the middle and fighting to be seen.

University of Arizona researchers also predict that there is a mismatch between the homes that will become available, and what younger homebuyers will be looking for:

“The study predicts that many baby boomers and members of Generation X will struggle to sell their homes as they become empty nesters and singles. The problem is that millions of millennials and members of Generation Z may not be able to afford those homes, or they may not want them, opting for smaller homes in walkable communities instead of distant suburbs.”

So: Is now a good time to sell a house?

“If you want to get top dollar for your property, now is the time to sell.” -Listing agent Windy Back

“Now is a really great time to sell because six months down the road, a year down the road, the economy won’t be the same.” -Listing agent June Piper-Brandon

Numerous factors have contributed to this being one of the best times to sell a house over the past decade. Take advantage of the unusual opportunity while it’s still around, instead of kicking yourself when the market slows down and you go from a multiple-bid situation to accepting offers for $10,000 below your asking price.

“Should I sell my house?” to recap, here’s why the answer is yes:

- Rising interest rates

- Backlog of foreclosures

- Increased home building activity

- End of COVID-19’s impact on market

- Baby boomer homes will increase inventory

Today, there is significant demand for most homes due to a lack of inventory – but that demand can change, and when it does change it will change quickly, giving homeowners little time to react. The best time to get top dollar for your home may be today, rather than tomorrow.