It is officially September and the start to a new month!

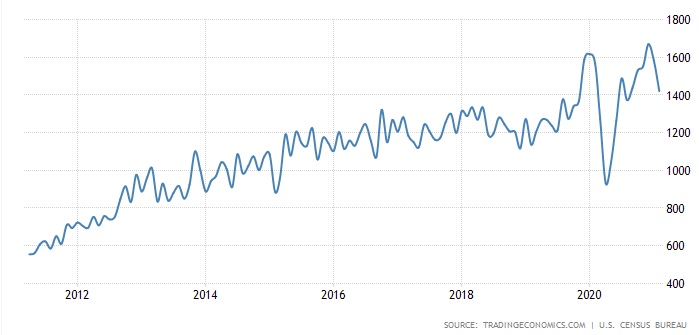

In the September issue of our newsletter you will find events this month, featured listings, market predictions for 2021, and how to follow us on social media.

Click the attachment to check it out!

Please don’t hesitate to reach out with any of your real estate needs.