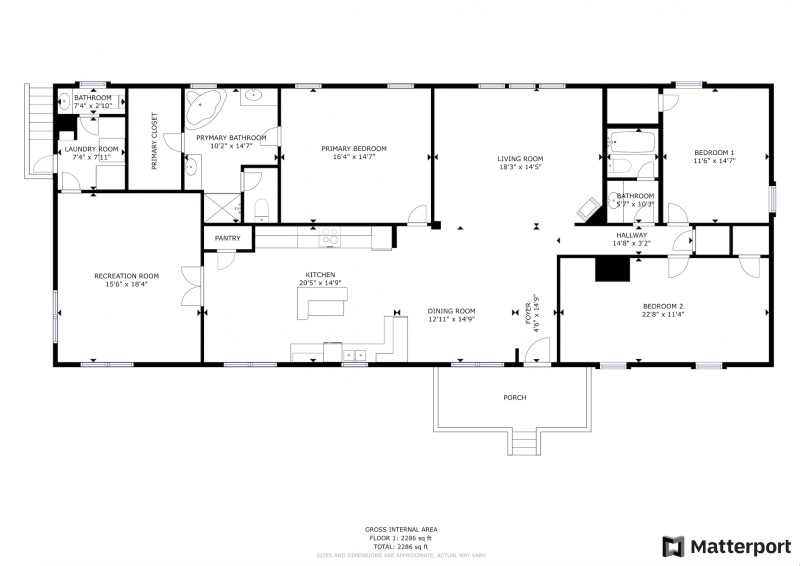

Tasteful and classic home located in the hard to find area off of NE 63 Street. This beautiful 4 bedroom, 3 bathroom home includes 2732 living square feet and was originally built in 1978 but updated over recent years(see below). Short and scenic driveway leads to a very private and secluded location on 1.78 landscaped acres with variety of hardwood trees. Walking up the paver sidewalk you will notice the Florida stacked stone, wood siding and metal roof. As you enter the home, to the right is a beautiful living room with wood tongue and groove and wood beam ceiling, stacked stone wood fireplace from floor to ceiling. The hallway leads to a nicely sized main bedroom with walk in closet and french doors leading to screened sitting area overlooking pool/spa. Updated main bathroom includes vanity w/ double sinks, tiled shower/ glass door and tiled floors. Guest bedrooms 2 & 3 are cozy in size and guest bathroom has been updated with new double sink vanity, steel tub ,new fiberglass shower surround and luxury vinyl flooring. Kitchen has been 100% redone with solid wood cabinets, granite countertops and all stainless steel appliances are included. Kitchen includes eat in area with bay window views and formal dining room on other side of passthrough window. Bedroom 4 is a suite with full bathroom including tiled shower, bay window sitting area and additional storage/closet space. Florida room is located just off dining area through sliding barn doors and leads to pool deck. Pool area is 1282 square feet(25’x51′), fully screened with 51′ of covered patio area to relax and enjoy views of pool and spa. Outside has several relaxing sitting areas…1st under shade trees, 2nd for late night fires and 3rd overlooking the large fields of green acreage on neighboring farm. New landscaping includes 2 rose gardens, established Monarch butterfly garden with milkweed and garden’s are full of tropical plants and well established with full irrigation system as well. Detached metal garage is 20’x22′ with 2 roll up doors and attached lean to are 11’x36 and 16’x20′. This home has it all and is true one of kind that anyone would love to call home. Updates – Kitchen redone recently – Main Bathroom remodel 7 years ago – Bathroom 2 remodeled recently – HVAC venting 8 years ago – 4.5 ton HVAC 3 years – All interior and exterior are new – New wood porch with ceiling fans – Metal roof 7 years ago. – Pool diamond bright 9 years ago. – Screen pool enclosure with updated wind resistance design 4 years ago – All new and updated lighting and ceiling fans throughout. – Blown insulation 8 years ago

ASKING PRICE $635,000

- 3 Bedrooms

- 2 Bathrooms

- 2,732 Living Sq. Ft

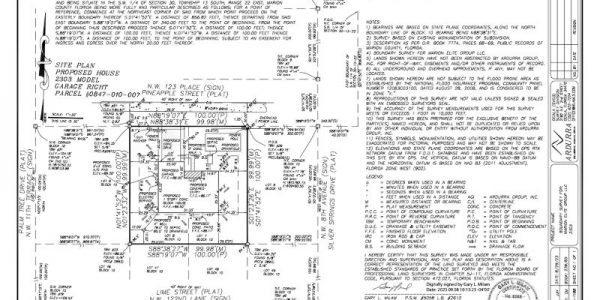

- 1.78 Acre Lot

- POOL HOME